>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

China’s factory activities unexpectedly slipped back into contraction in July mainly due to weaker market demand and falling commodities prices.

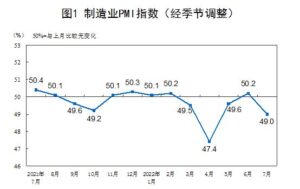

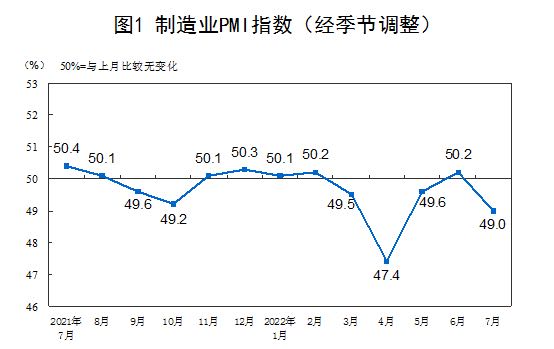

The official manufacturing Purchasing Managers’ Index (PMI) fell to 49 in July, according to data released by the National Bureau of Statistics (NBS) on Sunday, compared to 50.2 in the previous month and 50.4 expected by analysts .

Manufacturing PMI remained below the 50 mark that separates growth and contraction for three consecutive months in March – May due to the impacts of Covid-19 outbreaks, before returning to expansion in June.

The falling manufacturing PMI was mainly due to the traditional light production season, insufficient market demand and weaker momentum in high-energy-consuming industries, said Zhao Qinghe, senior statistician at the NBS, adding that China’s overall economic momentum declined and the foundation for economic recovery needs to be consolidated.

Almost all sub-indexes of July’s manufacturing PMI declined. That for production activities fell by 3 percentage points to 49.8 and that for new orders was 48.5, falling by 1.9 percentage points from the month before, both slipping back into contraction after rapid recovery in June.

The gauge for new export orders fell by 2.1 percentage points to 47.4 and the gauge for imports fell by 2.3 percentage points to 46.9, remaining in contractionary territory since April and March 2021, respectively.

Of the surveyed manufacturers, the share of companies that said market demand was insufficient rose for the fourth consecutive month to exceed 50% in July. “Insufficient market demand is currently the main challenge faced by developers,” said Zhao.

Sub-index for purchasing prices of raw materials fell by 11.6 percentage points to 40.4 in July, contracting for the first time since 2022, mainly driven by price fluctuations of bulk commodities such as crude oil, coal and iron ore. The sub-index for products’ factory-gate prices stood at 40.1, falling by 6.2 percentage points from June.

PMI of textile, fuel processing, ferrous metal smelting industries remained in contractionary territory, with PMI in the industries significantly lower than the overall manufacturing PMI, the NBS said.

Dragged by softer demand and production, manufacturers’ recruitment slowed, with the sub-index for employment falling slightly by 0.1 percentage point to 48.6.

The sub-index for suppliers’ delivery time stood at 50.1%, falling by 1.2 percentage points from June, suggesting suppliers’ material delivery time accelerated slightly in June.

Large and medium manufacturers’ PMI fell by 0.4 percentage point and 2.8 percentage points, respectively, to 49.8 and 48.5, slipping into contraction, while small-sized manufacturers’ activities contracting at a faster pace, with PMI falling by 0.7 percentage point to 47.9, according to the data.