>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

China’s factory activity contracted at a slower pace in May, pointing to recovery in manufacturing production and demand as COVID-19 curbs eased.

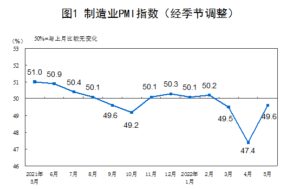

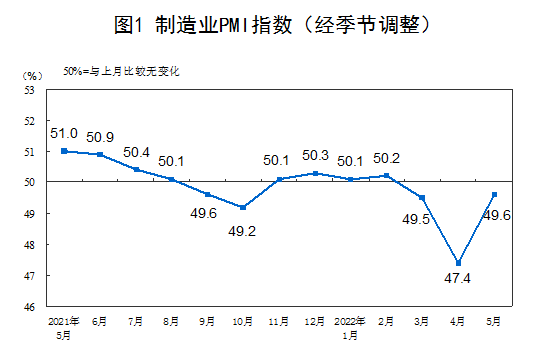

The manufacturing purchasing managers’ index (PMI) rose to 49.6 in May from 47.4 in the previous month, according to data released by the National Bureau of Statistics (NBS) on Tuesday.

The figure remained below the 50-point mark that separates contraction from growth for the third straight month, but it’s higher than 48.6 expected by analysts in a Reuters poll.

The sub-index for production in the manufacturing sector rose to 49.7 from 44.4 in April while that for new orders rose to 48.2 from 42.6, both remaining in the contractionary territory but pointing to recovery in both supply and demand.

The sub-index for new export orders increased by 4.6 percentage points to 46.2 in May and that for imports rose 2.2 percentage points to 45.1.

The gauge for raw material inventories improved by 1.4 percentage points to 47.9, and the gauge for suppliers’ delivery time increased by 6.9 percentage points to 44.1, pointing to easing pressure on the supply chain.

The recovery in manufacturing production and market demand has boosted employment, with the gauge rising by 0.4 percentage point to 47.6.

The sub-index for raw material purchasing price fell by 8.4 percentage points to 55.8, while that for factory-gate prices of finished products fell by 4.9 percentage points to 49.5, slipping into the contractionary territory for the first time since 2022, indicating that inflationary pressure from upstream industries still exists and manufacturers’ margins remains under pressure.

The sub-index for manufacturing companies’ business expectations picked up by 0.6 percentage point to 53.9 in May.

The figures showed manufacturing production and demand have recovered to varying degrees, but the recovery momentum needs to be strengthened, said Zhao Qinghe, senior statistician at the NBS, in a statement accompanying the data.

Notably, large-sized manufacturers’ PMI rose by 2.9 percentage points to 51 in May, returning to the expansionary territory, while PMI for medium- and small-sized manufacturers remained in contraction, at 49.4 and 46.7, respectively, though improving by 1.9 percentage points and 1.1 percentage points from the previous month.

“It shows the impact of COVID-19 outbreaks in May have not fully ended, leaving the economic outlook grim since the second quarter in 2020,” said Pang Ming, chief economist at Huaxing Securities.

Declines in China’s midstream and downstream production were larger than they were upstream and small firms were hit harder than large firms, Pang said.

China’s economy was ravaged by strict restrictions in April as the country grappled with the worst COVID-19 outbreak since 2020, with economic difficulties in some aspects now worse than two years ago.

Profits at China’s industrial companies declined at their fastest pace in two years in April as high raw material prices and supply chain disruptions eroded margins.

Though restrictions in the major manufacturing hubs of Shanghai and in the northeast eased in May, analysts said the output resumption was restrained by sluggish domestic consumption and softening global demand.

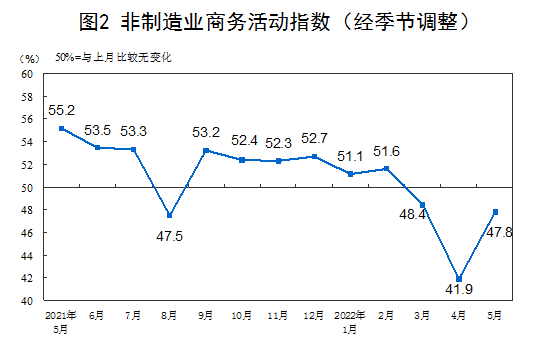

The NBS data also showed that China’s non-manufacturing PMI in May rose to 47.8 from 41.9 in April. The sub-index for the services sector was 47.1, compared to 40 in the previous month, while the sub-index for the construction sector was 52.2, edging down by 0.5 percentage point from April.

The employment sub-index in the services sector slipped to 45.3, down 0.5 of a point from April, showing sustained job market pressure.

China’s official composite PMI, which includes both manufacturing and services activity, stood at 48.4, up from 42.7.