>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

Activities in Chinese manufacturing and services sectors simultaneously slipped into contraction in March for the first time since the height of the COVID-19 outbreak in early 2020, bolstering expectations that authorities may have to step up stimulus measures to stabilise the economy.

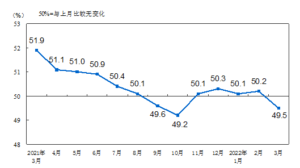

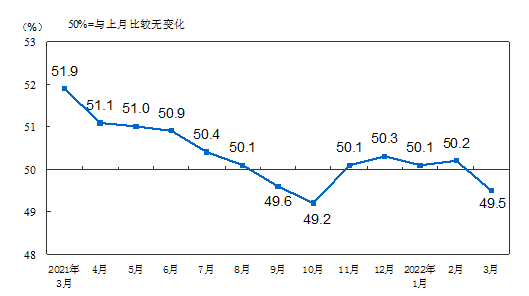

The official manufacturing Purchasing Managers’ Index (PMI) fell to 49.5 in March from 50.2 in the previous month, according to data released by the National Bureau of Statistics (NBS) on Thursday, slipping into the contractionary territory for the first time in five months.

The official non-manufacturing PMI eased to 48.4 from 51.6 in February, falling below the 50 mark that separate contraction from expansion for the first time since September 2021, showed the data.

The last time both PMI readings simultaneously dropped below the 50 mark was in February 2020, when the country imposed a nationwide lockdown to contain the initial Covid-19 outbreaks.

The world’s second-largest economy, which had shown signs of pick-ups in growth momentum in the first two months of the year, is now at risk of a sharp slowdown as authorities restrict production and mobility in COVID-hit cities, including the financial hub of Shanghai and the technology hub of Shenzhen.

“Recently, clusters of epidemic outbreaks have occurred in many regions in China, and coupled with sharply higher global geopolitical instability, production and operation of Chinese companies have been affected,” said Zhao Qinghe, senior NBS statistician.

Some companies also saw the cancellation or reduction of overseas orders due to geopolitical uncertainties, Zhao said.

In breakdown, production and new orders both fell to the contraction territory, with the two sub-indexes falling by 0.9 percentage points and 1.9 percentage points to 49.5 and 48.8, respectively, both marking the lowest level since November 2021.

In particular, the sub-indexes for production and new orders in the textile, garment and general equipment industries all slid below 45.

The sub-indexes for new export orders and imports fell to 47.2 and 46.9 in March, respectively, sliding 1.8 percentage points and 1.7 percentage points from the previous month, indicating further contraction in the country’s foreign trade activities.

While production and demand both slowed significantly, the gauges for prices continued to rise in March, indicating growing inflationary pressure.

The sub-index for manufacturers’ purchasing prices of raw materials surged 6.1 percentage points to 66.1, while the sub-index for their products’ factory-gate prices jumped 2.6 percentage points to 56.7, both marking the highest level in five months.

In particular, the two price sub-indexes for upstream industries, such as the oil, coal and other energy processing industry, ferrous metal smelting industry and non-ferrous metal smelting industry all jumped above 70 in March, adding more pressure on downstream industries’ production.

Weighed by shrinking demand and production, the manufacturing sector slowed hiring in March, with the sub-index for employment falling 0.6 percentage point to 48.6, marking the lowest level since March 2021. Manufacturers’ expectation weakened, with the sub-index falling to 55.7 from 58.7 in February.

“PMI weakened as the Omicron outbreaks in many Chinese cities led to lockdowns and disruption of industrial production,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management. “As the Shanghai lockdown only happened in late March, economic activities will likely slow further in April.”

“Due to the epidemic outbreaks, some companies in some areas temporarily reduced production or stopped production, which also affected the normal production and operation of both upstream and downstream companies,” Zhao said.

To cushion the impact of new COVID-19 lockdowns, authorities have unveiled steps to support business, including rent exemptions for some small services-sector firms.

On Wednesday, the government said it will roll out policies to stabilise the economy as soon as possible amid increased pressures.

The central bank, which kept its benchmark interest rate for corporate and household lending unchanged in March, is expected to cut rates and lower reserve requirements for banks as downward economic pressures build, analysts say.

China’s official composite PMI, which combined manufacturing and services, stood at 48.8 in March versus 51.2 in February.

The composite PMI was at its second-lowest reading on record since February 2020, when the initial COVID outbreak sent the index plummeting to 28.9.