>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

Shares of Chinese mainland property developers see a sell-off on Wednesday as market concerns grow after homebuyers in many cities said they would suspend repaying mortgage loans as the properties they bought were left unfinished.

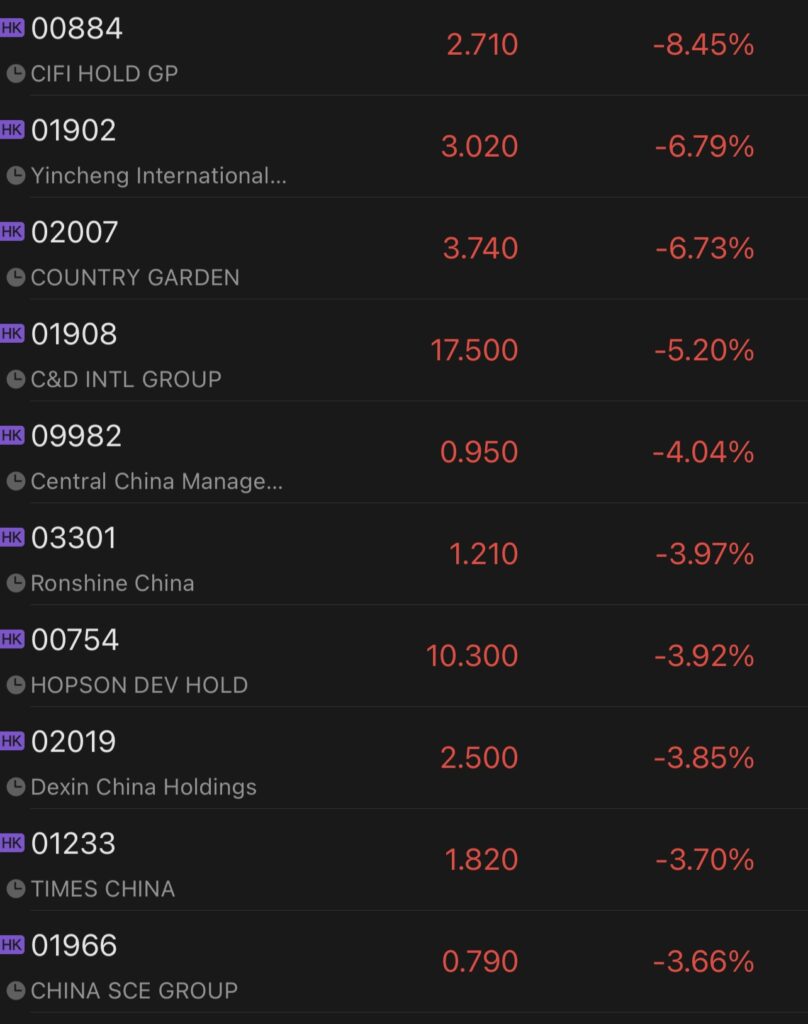

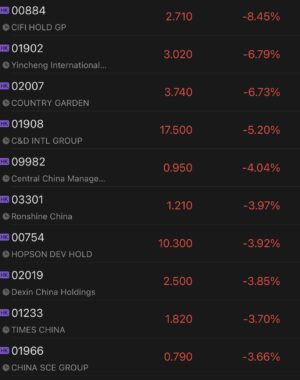

Country Garden, the country’s largest property developers by sales, slumped as much as 9% in Hong Kong, CIFI Holding sliding 8.5%, Times China down 3.7%, Guangzhou R&F Properties and Seazen Holdings down over 3%.

As of July 12, buyers of 52 property projects in several Chinese cities including Zhengzhou, Wuhan, Nanchang, Changsha, Taiyuan and Xi’an have issued statements about suspending repayment of their home mortgage loans because the properties they bought have been left unfinished and the construction has been suspended due to developers’ liquidity issues, according to The 21st Century Business Herald.

The developers include China Evergrande Group, Sinic Holdings, Greenland Holdings, Sunac China, Kangqiao Group, Xinyuan Group, Sichuan Languang Development Co, Zensun Group and Myhome Real Estate Development Group, etc, according to the report.

According a statement issued on July 7 by buyers of a project developed by Times China in Wuhan, homebuyers had made several attempts to safeguard their legitimate rights and failed to get any progress. “If the project does not resume construction by August 1, buyers of the project will all suspend repaying mortgage loans,” it reads.

Developers are seeing another maturities wall in July and August, with monthly debt maturities exceeding 100 billion yuan, according to the China Index Academy.

Citic Securities said in a recent note that real estate sales in July weakened again, indicating that the recovery in June was not solid and the sector’s credit risks are far from been resolved, and it also shows that it’s necessary for the government to step up efforts to support the sector.