>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

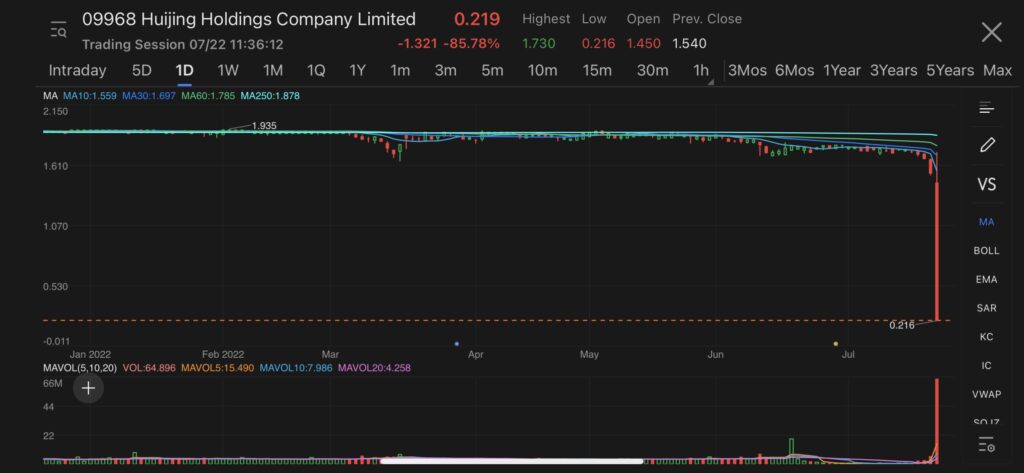

Chinese property developers Huijing Holdings is crashing more than 85% in Hong Kong to hit a new record low of HK$0.216.

The company completed swapping $107.6 million of its outstanding 12.5% bonds that came due on Thursday, July 21, with new debt securities maturing next year.

The Friday disclosure comes after the property developer obtained bondholders’ support for the refinancing of its 12.5% bonds via debt swap.

The $6.7 million accrued interest of its old 12.5% bonds will be settled separately in cash outside of the clearing systems. Huijing said it has reached out to the relevant bondholders to agree on the settlement arrangements.