>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

Shares of Chinese shipping companies staged a strong rally on Monday, with an index tracking the sector compiled by Wind Information surging 4.4% at the market close, making it one of the best-performing sectors in the A-share market.

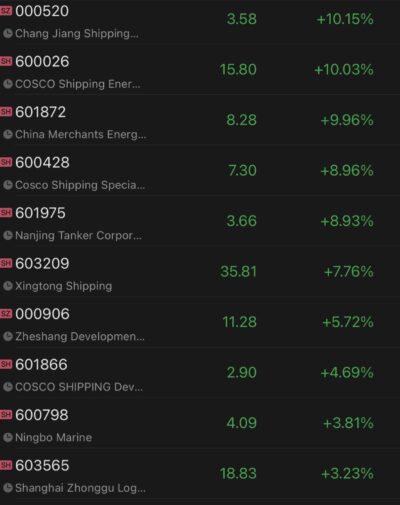

Chang Jiang Shipping Group Phoenix, COSCO Shipping Energy Transportation and China Merchants Energy Shipping surged by the daily limit of 10%. Cosco Shipping Specialize Carriers surged nearly 9%, Nanjing Tanker Corporation up 8.9%.

Spot rates for VLCCs (very large crude carriers) increased sharply last week in the latest sign of the beleaguered sector emerging from the doldrums of the pandemic.

Broker Howe Robinson reported time charter equivalent rates topping $40,000 per day for eco-designed ships on three key routes, up from $22,000 to $27,000 a week earlier. The Baltic Exchange’s VLCC TCE weighted average was also up sharply to $13,150 per day on Tuesday, just 11 days after rising above zero for the first time in 19 months.

VLCC freight rates on major routes to China have improved as state-run refiners move away from Russia’s flagship Urals crude following the invasion of Ukraine, according to energy data analyst Vortexa. Conventional suppliers from the Middle East and Atlantic Basin are likely to supply any additional Chinese demand with state-run companies cautious about lifting cargoes before the European Union’s ban on Russian oil imports by the end of the year, it said.