>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

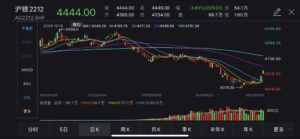

Precious metal stage a strong rally, with the most-traded silver futures contract on the Shanghai Futures Exchange, for December delivery, is surging nearly 5% to hit 4,449 yuan per tonne. The December gold contract is gaining 1.5% to hit 384.26 yuan per gram.

In the overseas market gold and silver rose sharply on Thursday, with gold logging its biggest one-day percentage gain since March and silver rallying by nearly 7% to finish at its highest price in a month.

Gold for October delivery gained $31.20, or 1.8%, to settle at $1,750.30 per ounce. That was the biggest one-day percentage gain for a most-active contract since March, FactSet data show. Silver for September delivery added $1.27, or 6.8%, to settle at $19.868 an ounce, for the highest finish since June 30.

Gold headed for its biggest weekly gain since mid-May amid speculation that the Federal Reserve will slow the pace of interest rate increases as the US economy slows.

While the Fed raised rates by 75 basis points again this week, the latest data showed the US economy shrank for a second consecutive quarter, meeting one of the common criteria for a technical recession, complicating the Fed’s push to stamp out soaring inflation with a string of aggressive rate rises.

Federal Reserve Chairman Jerome Powell had said on Wednesday that the next interest rate hike in September would depend on the tenor of upcoming US economic data.

Precious metal stage a strong rally, with the most-traded silver futures contract on the Shanghai Futures Exchange, for December delivery, is surging nearly 5% to hit 4,449 yuan per tonne. The December gold contract is gaining 1.5% to hit 384.26 yuan per gram.

In the overseas market gold and silver rose sharply on Thursday, with gold logging its biggest one-day percentage gain since March and silver rallying by nearly 7% to finish at its highest price in a month.

Gold for October delivery gained $31.20, or 1.8%, to settle at $1,750.30 per ounce. That was the biggest one-day percentage gain for a most-active contract since March, FactSet data show. Silver for September delivery added $1.27, or 6.8%, to settle at $19.868 an ounce, for the highest finish since June 30.

Gold headed for its biggest weekly gain since mid-May amid speculation that the Federal Reserve will slow the pace of interest rate increases as the US economy slows.

While the Fed raised rates by 75 basis points again this week, the latest data showed the US economy shrank for a second consecutive quarter, meeting one of the common criteria for a technical recession, complicating the Fed’s push to stamp out soaring inflation with a string of aggressive rate rises.

Federal Reserve Chairman Jerome Powell had said on Wednesday that the next interest rate hike in September would depend on the tenor of upcoming US economic data.