China’s factory activity remained in contractionary territory for the fifth consecutive month in August but shrank at a slower pace amid a global economic slowdown and sluggish domestic demand.

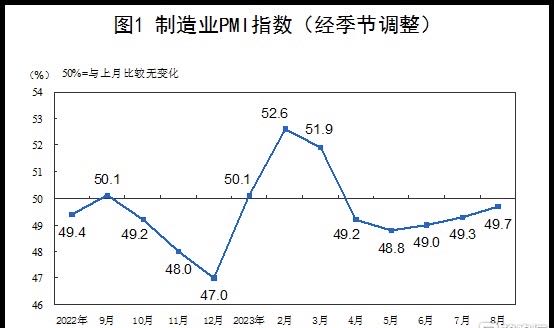

The official manufacturing purchasing managers’ index (PMI) came in at 49.7 in August, extending the contraction since April this year but picking up slightly from 49.3 in the previous month, according to data released by the National Bureau of Statistics reported on Thursday.

August’s reading is a few ticks above a Reuters poll, in which economists predicted August’s figure would come in at 49.4.

Insufficient market demand remains the major problem faced by companies and the foundation for the manufacturing sector’s recovery needs to be further consolidated, said Zhao Qinghe, senior statistician at the NBS.

Production and market demand both improved in August, with the sub-index for new orders rising by 0.7 percentage points to 50.2%, returning to growth, while the sub-index for production rising by 1.7 percentage points to 51.9%, showed the NBS data.

The sub-index for raw material purchasing prices picked up by 4.1 percentage points to 56.5 and the sub-index for products’ factory-gate index picked up by 3.4 percentage points to 52, returning to growth for the first time in six months, showed the data.

The sub-index for raw material inventory stood at 48.4, rising slightly by 0.2 percentage point from the previous month, indicating that the manufacturing sector’s raw material inventory fell at a slower pace.

The sub-index for employment stood at 48, falling slightly from previous 48.1, while the sub-index for suppliers’ delivery time was 51.6%, rising by 1.1 percentage point from the previous month, indicating faster material delivery.

The sub-index for manufacturers’ business expectations reached 55.6 in August, picking up by 0.5 percentage points from July, indicating that companies’ market confidence picked up after the government rolled out a series of supportive policy measures.

In breakdown, large manufacturers’ PMI rose by 0.5 percentage points to 50.8 in August, remaining in expansionary territory for the third consecutive month, while medium-sized and small-sized manufacturers remained in contractionary territory, with PMI rising by 0.6 percentage points and 0.3 percentage points to 49.6 and 47.7, showed the data.

Meanwhile, the official non-manufacturing PMI for August fell to 51, from 51.5 in the previous month, remaining in the expansionary territory but continuing a downward spiral from a high of 58.2 in March, showed the NBS data.

The service sector dragged the figure down, offset by growth in construction activity — likely thanks to infrastructure projects, as local government bond issuances grew.

China’s central bank cut a key lending rate earlier this month to help shore up the economy amid weak consumer spending and fresh signs of stress in the property sector. But market players said the 10 basis point cut to the one-year loan prime rate, the second in three months, was insignificant, while homebuyers were disappointed that the mortgage-linked five-year loan rate was left unchanged.