China’s real estate development investment declined at a slightly faster pace in Q1 of 2025, while new home sales area and sales value fell a slower rate. Home inventory at the end of March declined, but property developers’ fundraising fell at a steeper pace.

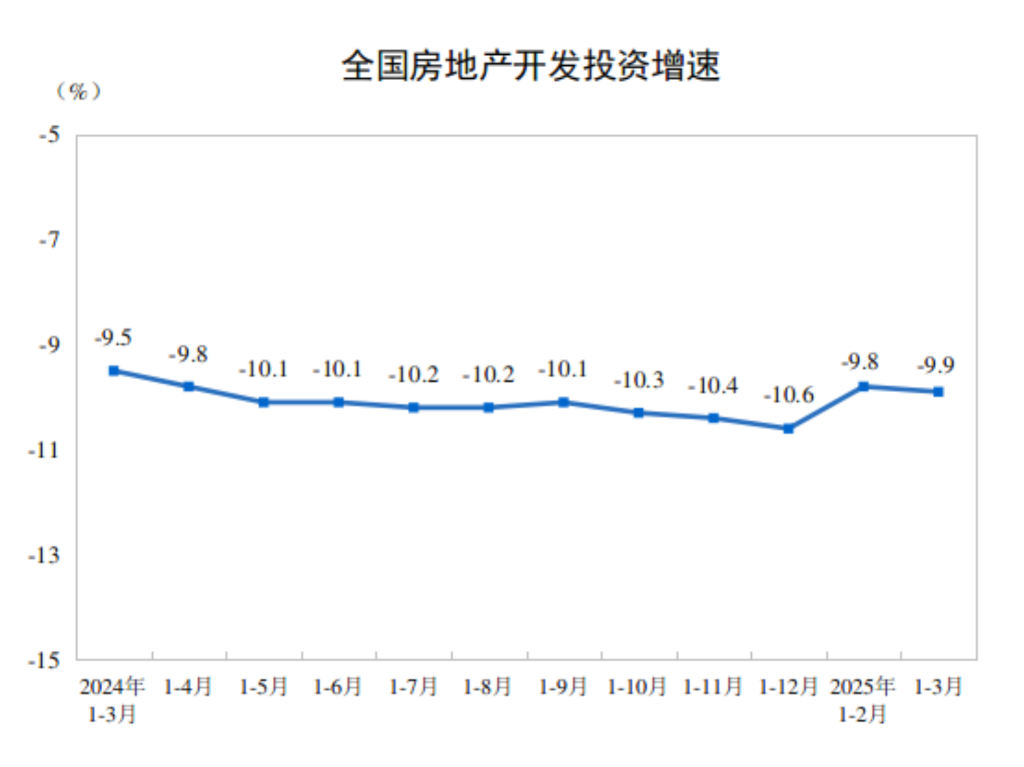

China’s real estate development investment reached RMB 1.99 trillion in the January – March period, sliding by 9.9% year-on-year, widening slightly from the 9.8% drop for the first two months, according to data released by the National Bureau of Statistics.

Among this, residential property investment was RMB 1.5133 trillion, down 9% from a year earlier, showed the data.

New housing construction starts reached 129.96 million square meters during the period, sliding by 24.4% year-on-year, of which residential starts fell 23.9%, while the completed floor area reached 130.6 million square meters, down 14.3%, of which residential completions fell 14.7%, showed the data.

During the same period, new property sales, in terms of floor area, reached 218.69 million square meters, down 3% year-on-year, narrowing by 2.1 percentage points from the drop in the January–February period, and among this, residential sales area fell by 2%.

New property sales, in terms of value, reached RMB 2.08 trillion during the period, down 2.1% year-on-year, narrowing by 0.5 percentage points, and among this, residential sales value fell by 0.4%.

At the end of March, new property inventory stood at 786.64 million square meters, a decrease of 12.27 million square meters from the end of February, and of this, the residential portion fell by 10.17 million square meters.

Chinese property developers’ fundraising totaled RMB 2.4729 trillion in Q1, down 3.7% year-on-year, widening slightly from the 3.6% drop during the first two months, and of this, domestic loans fell 2.35 to RMB 444.1 billion, foreign capital slumped 83.25 to RMB 100 million, self-raised funds fell 5.8% to RMB 816.8 billion, down payments and advance receipts fell 1.1% to RMB 733.5 billion, home mortgage loans fell 7% to RMB 337.3 billion.

NBS Deputy Director Sheng Laiyun said that China’s real estate market showed clear signs of recovery in the quarter, with policies aimed at stabilizing the sector continuing to take effect.

Overall, the real estate market remains in a phase of adjustment, and demand still needs to be further unleashed, he said.

As China’s consumption structure continues to upgrade and urbanization is still underway, there remains significant market demand—especially for high-quality housing.