>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

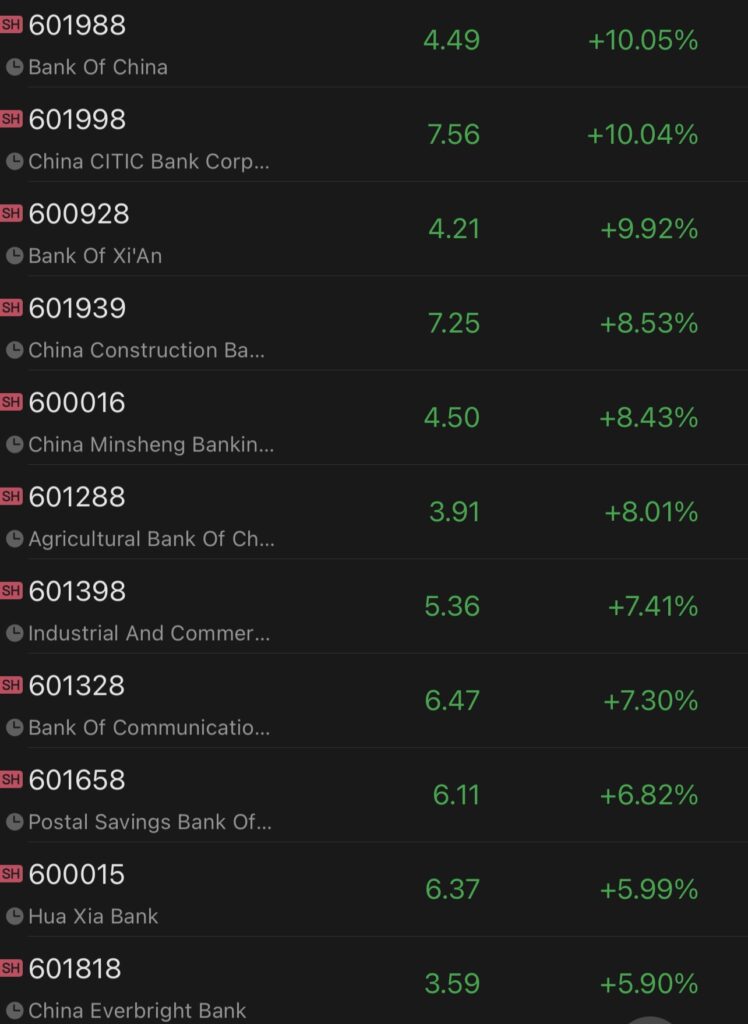

Chinese banks stage strong rally in Hong Kong and the A-share market on expectation of recovery in earnings and valuation.

An index tracking mainland-listed banks compiled by Wind Information surged by nearly 4% in the morning session on Monday, making it one of the best-performing sectors.

Bank of China surged by the daily limit of 10% at one point in Shanghai to hit the highest in nearly eight years since July 2015, bringing its year-to-date gain to more than 40%. Citic Bank also hit limit-up to hit a new high in eight years and brought the gains so far this year to nearly 52%.

Analysts believe that the growth of bank earnings has hit the bottom in the first quarter, and looking ahead, given the stable loan offering combined with some banks’ cut of deposit rates, will help stabilize interest rate spreads, improve the industry’s business outlook and boost the recovery of banking shares’ valuations.

Some national banks in China recently lowered their deposit rates to cope with the pressure of narrowing net interest margins (NIMs).

Banks including Czbank , HengFeng Bank and China Bohai Bank have announced that they would cut deposit rates for certain maturities by up to 30 basis points.

Among them, the listed interest rate for one-year deposits would drop from 1.95% to 1.85%, and the listed interest rate for five-year deposits would sink from 3.25% to 2.95%.