>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

China’s consumer prices grew at a slower pace in August while producer prices rose at the slowest pace in 18 months, reflecting an economy plagued by weak domestic demand and leaving room for further central bank policy easing.

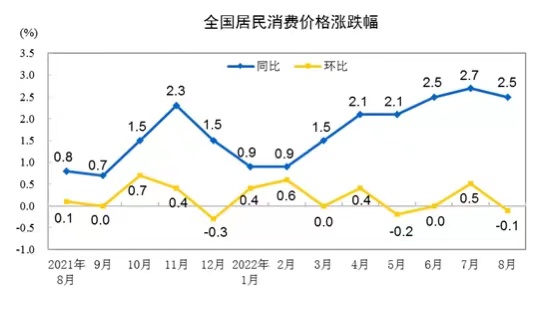

The consumer price index (CPI) grew by 2.5% in August from a year earlier, showed data released by the National Bureau of Statistics (NBS), slower than 2.7% in July and the 2.8% average forecast in a Reuters poll of analysts.

Slower growth in consumer prices came as food prices rose 6.1% on year in August, slowing from the 6.3% growth in the month before. Pork prices grew by 22.4% on year last month, accelerating by 2.2 percentage points from July. Prices of vegetables, gains and eggs grew by 6%, 3.3% and 1.7%, respectively, all slower than the previous month.

Non-food prices grew 1.7%, decelerating from July’s 1.9% gain, with prices of gasoline, diesel and LPG growing by around 20% year over year, though slower than the previous month, and service prices growing by 0.7%, matching the month before.

Core CPI, which excludes volatile food and energy prices, rose 0.8% on year in August, in line with the growth in the previous month.

On a month-on-month basis, the CPI fell 0.1% from July, after rising 0.5% in July from June, and compared with 0.2% forecast in the Reuters poll.

The producer price index (PPI) rose 2.3% year over year in August, the slowest pace since February 2021, and decelerating from the 4.2% growth in July and 3.1% gain expected by analysts in a Reuters poll.

Prices in the coal mining and coal washing industry; oil and gas exploration industry; fuel processing; and chemical industry slowed by various degrees, while prices in the ferrous metal smelting industries and non-ferrous metal industry declined at a faster pace, partly eased cost pressure on downstream industries, according to the NBS.

In addition to high comparison base in 2021, the slower PPI growth in August was also attributable to falling crude oil and non-ferrous metal prices in the global markets; the effect of the government measures to ensure supplies of coal and other commodities; and sluggish steel demand, said Dong Lijuan, senior statistician at the NBS.

Month on month, the PPI fell 1.2% in August from July, when it declined 1.3% from June.

“Factory gate inflation is set to fall further throughout the rest of the year thanks to a continued drop back in commodity prices and a higher base for comparison,” according to a note from Capital Economics.

“We think CPI inflation will remain below the PBOC’s 3% ceiling,” they said, referring to the People’s Bank of China (PBOC).

Official and private data indicates that the Chinese economy continue to lose momentum in August, where property market weakness, COVID-19 containment measures and power shortages have dented consumption and factory activity.

The PBOC in August said China faces rising structural inflation pressure and consumer inflation might exceed 3% in some months in the second half of the year.

Analysts said slowing inflation could give some room for further monetary policy easing.

“As such, the PBOC will not be constrained to ease policy further to support economy,” said Yue and Huang. “The PBOC had lowered most policy rates in August, and we continue to anticipate more policy rate cuts during the rest of the year.”

China’s cabinet announced more steps on Thursday to spur investment, state media reported, extending a raft of measures to bolster an economy ravaged by COVID-19.

“We expect further easing will come in the form of quantity-based tools to provide liquidity support as well as structural tools like additional re-lending quotas for focus areas like manufacturing and green investment,” said HSBC economist Erin Xin.