>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

China’s producer prices fell at their fastest pace in over seven years in June, while consumer prices teetered on the edge of deflation, adding to the case for policymakers to use more stimulus to revive sluggish demand.

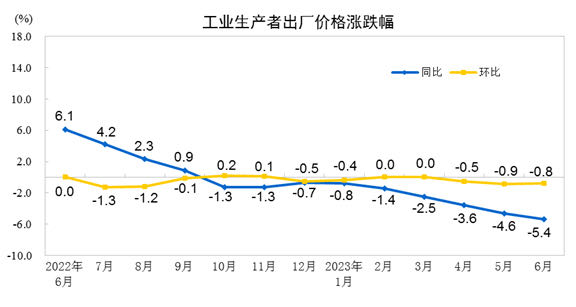

The producer price index (PPI) fell for a ninth straight month in June, sliding 5.4% from a year earlier, the National Bureau of Statistics (NBS) said on Monday, marking the fastest decline since December 2015. That compared with a 4.6% drop in the previous month.

For producer prices, the biggest year-on-year declines were seen in energy, metals and chemicals as domestic and foreign demand weakened.

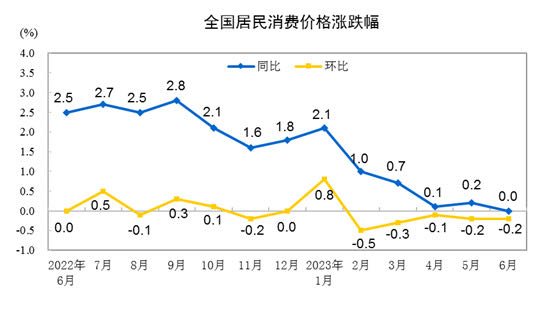

The consumer price index (CPI) was unchanged year-on-year, compared with the 0.2% gain seen in May, driven by a faster fall in pork prices. That dashed expectation for a 0.2% rise and was the slowest pace since February 2021.

In breakdown, food prices rose by 2.3% in June from a year earlier, compared with a rise of 1% in May, while non-food prices fell by 0.6% after having remained flat in May.

Prices for pork, a staple on Chinese dinner tables, decreased by 7.2% in June from a year earlier, fruit prices increased by 6.4%, and vegetable prices increased by 10.8%.

China’s core consumer inflation rate, excluding the volatile prices of food and energy, increased by 0.4% in June compared with a year earlier, down from 0.6% growth in May.

Nomura said the market is braced for further negative consumer inflation in July as “disinflationary pressures stay highly entrenched”, which calls for further monetary easing from the central bank.

They forecast China’s CPI will fall by 0.5% in July, while it will rise by just 0.3% in 2023 overall, which is far behind Beijing’s annual target of 3%.

The “ultra low” readings are likely to prompt the central bank to further cut policy rates and banks’ reserve requirement ratio later this year to release liquidity from the banking system as part of efforts to prop up the economy, the Nomura analysts added.