>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

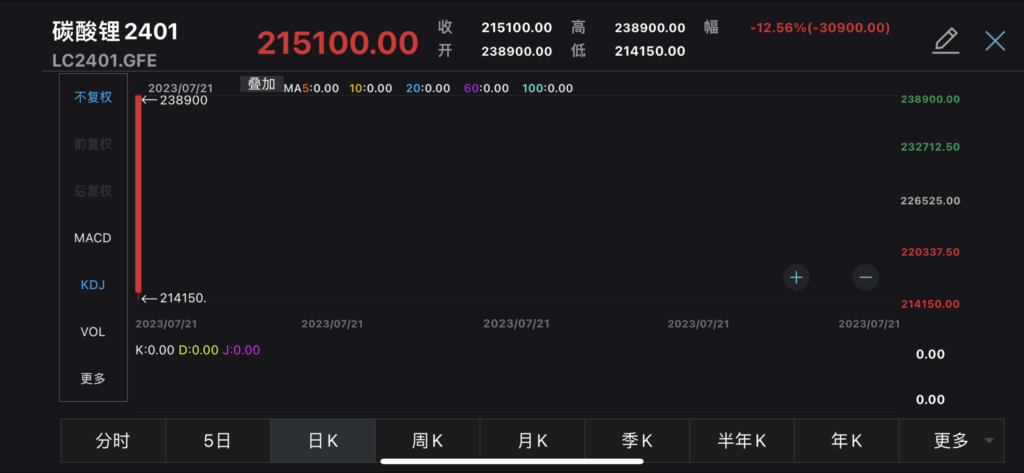

China’s most-traded lithium carbonate futures contract on the Guangzhou Futures Exchange, for January 2024 delivery, tumbled as much as 13% to hit a low of 214,150 yuan per tonne on the first day of tradings, before closing 12.65 down at 215,100 yuan per tonne

The base price for lithium carbonate futures contract at 246,000 yuan per tonne.

Other lithium carbonate futures contracts on the exchange, for delivery in February, March, April, May, June and July all hit limit-down, slumping by 14% to 211,600 yuan per tonne.

The sell-off came as the industry’s concern about surging supply in 2024. Ma Rui, battery material analyst at Shanghai Metals Market said that lithium demand grew exponentially in 2021 – 2022, which mismatched the supply of upstream lithium resources, left a large shortage in supply and sent lithium prices surging.

In 2023 – 2024, many lithium mining projects resumed in the previous two year will gradually put into operation, but lithium demand has slowed and the oversupply is expected to peak in 2024, said Ma.

From the end of 2023 to 2024, lithium carbonate supply will grow at a faster pace than market demand, leaving an oversupply, and spot market price will gradually decline from 300,000 yuan per tonne, according to Guotai Junan Securities.