>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

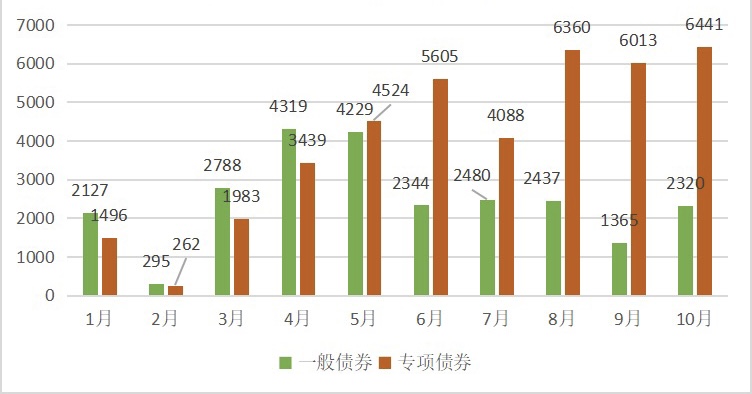

Chinese local governments issued 644.1 billion yuan special-purpose bonds in October, the highest monthly level this year, according to data released by the Ministry of Finance on Tuesday.

They issued a total of 876.1 billion yuan of bonds last month, which also included 232. billion yuan of general-purpose bonds, showed the data. In terms of purposes, the bonds included 614.5 billion yuan of new bonds and 261.6 billion yuan . . .

Sign In or Subscribe To Get Full Access.

Real-Time Updates on China Market Throughout Every Trading Day! With Data and Details You Don't Seen Anywhere Else!

Grab Our Welcome Offer! Only $0.5 A Day!

Sign Up For Free Weekly China Market Highlights HERE!