>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

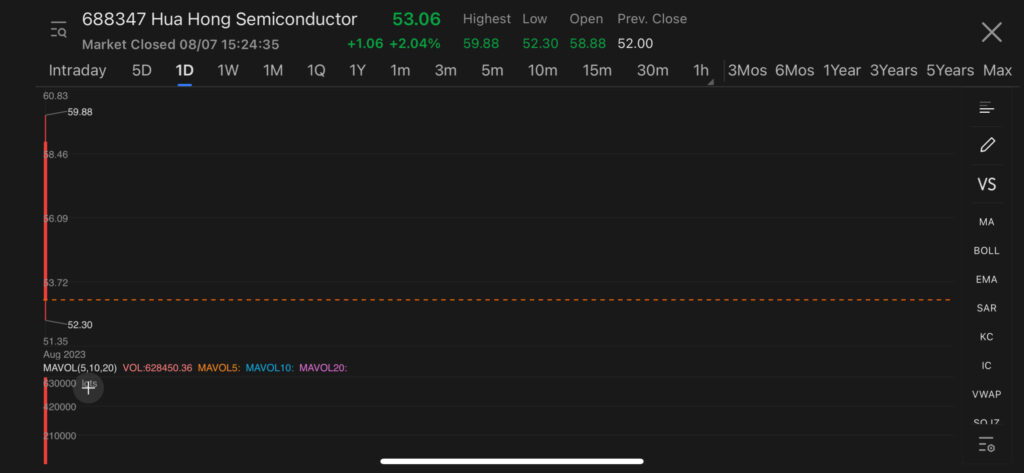

Hua Hong Semiconductor, the second largest chip foundry in China, hit as high as 59.88 yuan per share on the first day of trading on the tech-focused Star Market in Shanghai, from its offering price of 52 yuan per share, closing 2% higher at 53.06 yuan.

The company’s Hong Kong-traded shares tumbled 11% to close at HK$23.45, the biggest drop since May 2022.

Hua Hong sold 408 million shares, or 24% of its total share capital to raise 21.2 billion yuan ($2.96 billion) in the largest public offering in China this year. Half of the offering was alloted to 30 strategic investors, with the rest distributed among funds and individuals.

Hua Hong will use most of the proceeds to boost capacity at a facility in Wuxi, in eastern Jiangsu province, according to the company’s prospectus.

Hua Hong joins a long queue of local chipmakers to tap the stock market to fund expansion as Beijing seeks self-sufficiency in an escalating technology war with Washington.

US-China tensions over semiconductors began with the Trump administration’s trade war and have ratcheted up under President Joe Biden’s leadership as Washington looks to undercut Beijing’s efforts to build its high-tech industry.

Hua Hong’s listing on Shanghai’s Star board follows a 2014 initial public offering in Hong Kong, where it raised about HK$2.6 billion. The company makes semiconductors on 200mm wafers for specialty applications, providing products for consumer electronics, communications and computing.