China’s technology hub Shenzhen will promote mergers and acquisitions of the city’s listed companies, eyeing a combined market capitalization of more than 15 trillion yuan by the end of 2027 and aiming to achieve over 100 M&A deals with a total transaction value of over 30 billion yuan, according to a draft action plan for promoting M&As during the period of 2025 – 2027 released by the local financial authorities.

The city hopes to create exemplary cases of M&A to guide and inspire broader industry growth, positioning Shenzhen as an influential innovation and capital hub, according to the plan.

It will support listed companies in focusing on strategic emerging industries and future industries for M&A activities, encourage cross-sector acquisitions aimed at transformation and upgrading, back the acquisition of high-quality, loss-making assets that can strengthen supply chains and improve critical technological capabilities, provided safeguards for minority shareholders and continuity in operations are maintained.

It prioritizes industries such as integrated circuits, artificial intelligence, biomedicine, and other critical and emerging sectors, and supports M&A efforts by tech companies with proprietary intellectual property and breakthrough core technologies to resolve bottleneck issue.

Shenzhen will also actively seek national support for pilot projects in financial technology, green and low-carbon fields, and other emerging areas for M&A activities by listed companies.

For cross-border M&As, Shenzhen will assist leading companies in acquiring overseas assets, including supporting financing through Hong Kong listings or refinancing, improving M&A efficiency, and expanding resource integration across domestic and international markets.

Specific measures include encouraging domestic and foreign institutions to invest in technological applications, promoting collaboration between technology companies and relevant countries’ industrial chains, and enhancing connectivity between the Shenzhen and Hong Kong stock exchanges to explore deeper integration of equity and bond financing mechanisms.

This plan aligns with the “Six M&A Policies” issued by the China Securities Regulatory Commission in September, which aimed to invigorate the M&A market and leverage capital markets as a primary channel for corporate restructuring.

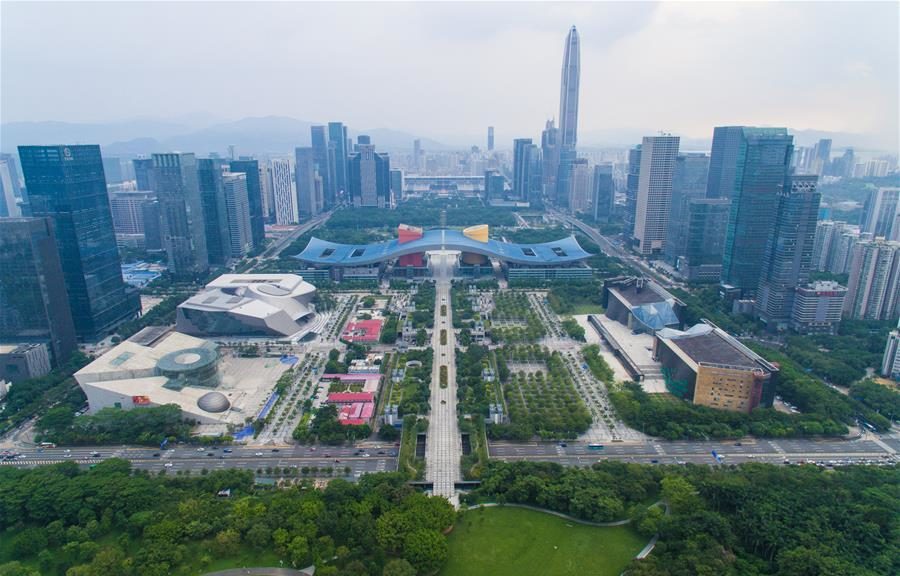

Since the release of the “Six M&A Policies,” emerging industries have become the focus of M&A activities, triggering a new wave of acquisitions. Shenzhen, as a hub for strategic emerging industries and innovative enterprises, has substantial demand and resources for M&A projects, drawing significant market attention.

Data from Wind Information shows that Shenzhen has 574 domestic and overseas listed companies, including 422 A-share companies with a combined market value of about 9.66 trillion yuan. In addition, Shenzhen is home to 25,000 national high-tech enterprises and 1,040 “Little Giant” companies specializing in cutting-edge technologies.

Shenzhen has already made progress in leveraging M&A to drive industrial consolidation and upgrading. According to the Shenzhen Municipal Financial Office, local listed companies and their subsidiaries have completed 34 M&A projects in 2024, with a total transaction value of 10.25 billion yuan, marking a new high in recent years.

M&A is widely regarded as an effective strategy for improving a company’s core competitiveness and enhancing long-term market value. For example, TCL Technology’s subsidiary CSOT recently announced a plan to acquire LG Display’s subsidiary for 10.8 billion yuan, the largest A-share M&A project disclosed since the release of the “Six M&A Policies” and representing the largest acquisition of foreign assets by a domestic company in 2024.