Chinese property developers’ 2022 earnings to hit five-year low – research

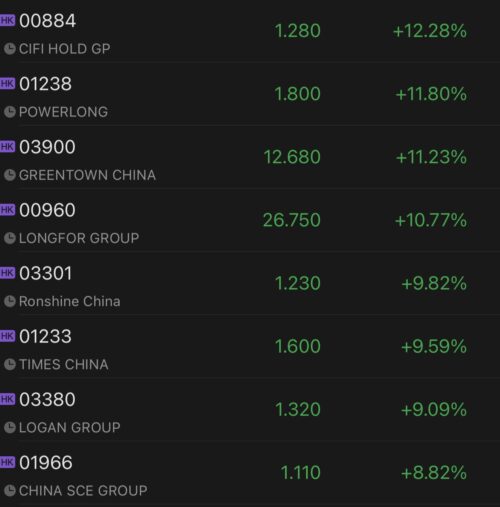

Chinese property developers’ 2022 earnings are expected to hit five-year low, with sector’s core earnings sinking 57% from the previous year, according to estimates by Citi Research.