>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

China’s economy showed signs of modest growth in November as industrial production and retail sales grew at a faster pace, while investment stayed steady as real estate investment remained weak despite the government’s policy support.

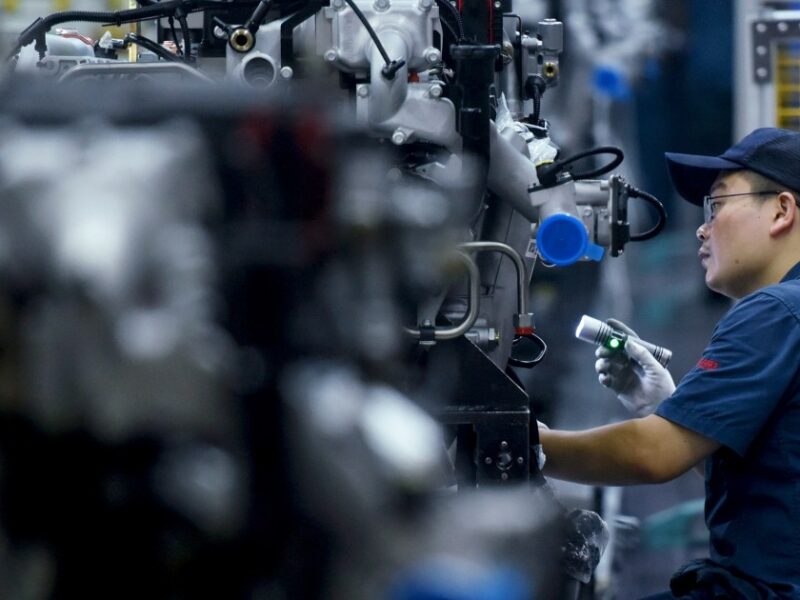

Industrial output grew by 6.6% in November from a year earlier, according to data released by the National Bureau of Statistics (NBS), compared to the 4.6% growth in the previous month and expected 5.6% growth.

During the first 11 months of the year, industrial output grew by 4.3% year over year, showed the data.

In breakdown, the mining sector’s output grew by 3.9% in November from a year earlier, picking up by 1 percentage point from the previous month and marking the fastest this year; the manufacturing sector’s output grew by 6.7% accelerating by 1.6 percentage point, and the utilities sector’s output grew by 9.9%, marking the fastest pace since September 2022 and accelerating by 8.4 percentage points, showed the data.

Among the 41 major industries, 28 industries’ output recorded positive year-on-year growth in November, in line with the number in October.

In particular, the output of the ferrous and non-ferrous smelting industries grew by 5.1% and 10.2%, respectively, slowing by 2.2 percentage points and 2.3 percentage point. The automobile manufacturing industry’s output grew by 20.7% on year in November, accelerating by 9.9 percentage points from October, and the computer, telecommunicating and other electronics manufacturing industry’s output grew by 10.6%, picking up by 5.8 percentage points; and the drug-making industry’s output fell by 8.1%, showed the data.

China’s retail sales grew by 10.1% in November from a year ago, according to the data, picking up from the 7.6% growth in the previous month, but missing market expectation of 12.6% growth.

In breakdown, retail sales of products rose by 8% in November from a year earlier, while catering revenue surged 25.8%, showed the data.

During the first 11 months of the year, China’s retail sales grew by 7.2% from the same period last year, with retail sales of products rising by 5.9%, while catering sales rose 19.4%, according to the data.

China’s online retail sales grew by 8.1% in November from a year earlier, picking up by 4.5 percentage points from the pervious month, and in the first 11 months of the year, online retail sales grew by 11% on year, slowing by 0.2 percentage points from the January – October period.

China’s fixed-asset investment grew by 2.9% in the January – November period compared to a year earlier, in line with the 2.9% growth for the first ten months of the year and remaining at the slowest level since 2021.

In breakdown, infrastructure investment grew by 5.8% year over year in January – November, slowing by 0.1 percentage point from the first ten months of the year, and manufacturing investment grew by 6.3%, accelerating by 0.1 percentage point, showed the data.

China’s real estate investment fell 9.4% in the January – November period from a year earlier, according to data released by the National Bureau of Statistics, compared to the 9.3% growth during the first 10 months of the year, in line with expected 9.4% growth.

Friday’s data follows other November indicators that show the economy struggling for momentum. Imports extended declines and while exports grew for the first time in six months, analysts attributed this to manufacturers offering unsustainable discounts. Consumer prices, meanwhile, fell at the fastest in three years and factory deflation deepened.

This week, top leaders said they would step up policy adjustments to support economic recovery in 2024, with a focus on boosting domestic demand. Beijing and Shanghai on Thursday announced relaxed home purchase restrictions, including reductions to the minimum deposit ratio for first and second homes.