>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

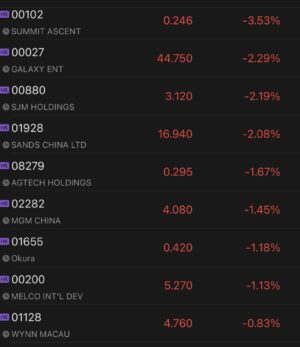

Shares of Macau’s casino operators are trading lower in Hong Kong as weak performance in the second quarter. As of 11:57 am local time, shares of Galaxy Entertainment is down 2.3%, SJM Holdings down 2.2%, Sands China down 2.1% and MGM China down 1.5%.

Macau’s VIP Gross Game Revenue (GGR) over the second quarter of 2022 reach only 1.988 billion patacas, representing a 76.6% contraction from that of 8.503 billion patacas in the same period last year, reported Macao Daily News, citing data released by the Macau Gaming Inspection and Coordination Bureau.

The VIP GGR accounted for 23.4% of Macau’s overall GGR of 8.495 billion patacus in the second quarter, down 10.1 percentage points from the previous year.

Morgan Stanley lowered the forecast of Macau’s 2022-23 total GGR to $7 billion and $16 billion, respectively, below the market consensus by 38% and 30%, according to a note on Tuesday.

Macau’s GGR is expected to reach 53.704 billion patacas in 2022, sliding 38% year earlier and representing only 18% of 2019 GGR, and reach 128.681 billion patacas in 2023, up 1.4 times year over year and representing 44% of 2019 GGR, the bank said.

The rating for Galaxy Entertainment was downgraded from Overweight to Equalweight, with its target price trimmed from $49 to $47.5. Wynn Macau was upgraded from Equalweight to Overweight, with its target price added from $6 to $6.5. Sands China was kept at Overweight, with its target price reduced from $22.5 to $22.

Morgan Stanley highlighted that the upgrade for Wynn Macau was based on its compelling valuation and upside potential once reopening becomes visible. Sands China was selected as the top pick among casino shares, after receiving a $1 billion loan from its controlling shareholder LVS.