>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

China’s lithium carbonate futures on the Guangzhou Futures Exchange continue to plummet on Monday after a massive sell-off on the trading debut on Friday, with some contract dropping below 200,000 yuan per tonne mark.

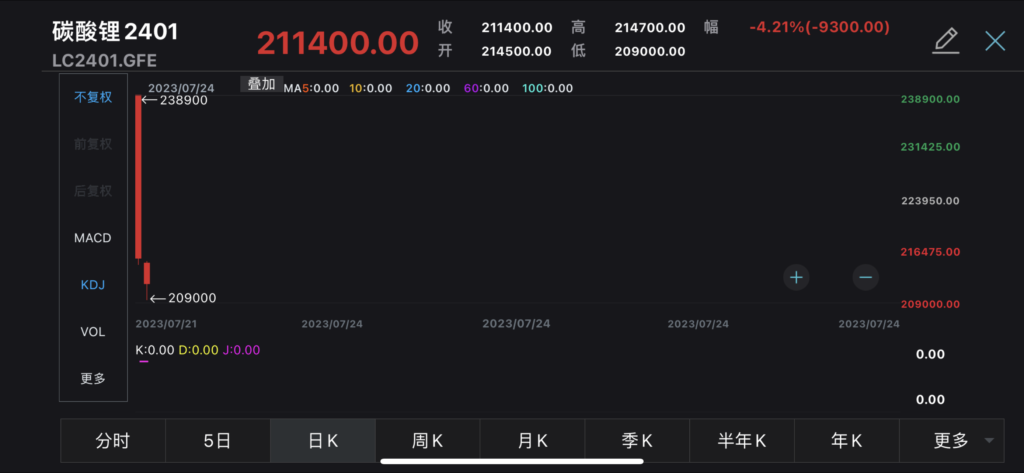

The most-traded contract, for January delivery, fell by 4.2% to close at 211,400 yuan per tonne after slumping as much as 13% on trading debut on Friday.

The February contract dived more than 7% to close at 199,400 yuan per tonne. The contracts for 2024 March, Apri, May, June and July delivery all plunged by more than 10% to close between 178,000 – 189,000 yuan per tonne.

In the spot market, the price of battery-grade lithium carbonate fell 2,500 yuan per tonne to 285,500 yuan per tonne on Monday, hitting a new low in more than two months and sliding for the 9th consecutive day, according to data from the Shanghai Metals Market. The price declined by 15,000 yuan per tonne in the recent five days and by 26,000 yuan per tonne in the recent 30 days.

Lithium producers also saw a sell-off, with Tianqi Lithium and Ganfeng Lithium sliding about 5% in the A-share market.

The sell-off came as the industry’s concern about surging supply in 2024. Most market insiders believe that lithium price will drop below 200,000 yuan per tonne in 2024 and the performance of the futures contract is reflecting the expectation, said an industry insider.

The global lithium salt demand and supply are expected to remained largely balanced in 2023, without large shortage or oversupply expected and the global market is highly likely to see oversupply in 2024 – 2025, according to China Futures.

Lithium demand grew exponentially in 2021 – 2022, which mismatched the supply of upstream lithium resources, left a large shortage in supply and sent lithium prices surging, said Ma Rui, battery material analyst at Shanghai Metals Market.

In 2023 – 2024, many lithium mining projects resumed in the previous two year will gradually put into operation, but lithium demand has slowed and the oversupply is expected to peak in 2024, said Ma.

From the end of 2023 to 2024, lithium carbonate supply will grow at a faster pace than market demand, leaving an oversupply, and spot market price will gradually decline from 300,000 yuan per tonne, according to Guotai Junan Securities.