>>REAL-TIME UPDATES IN THE WIRE. CLICK HERE<<<

Lithium prices remain sluggish in China’s domestic market amid weak demand and cautious market sentiment.

Price of battery-grade lithium carbonate remains unchanged for the second straight day at 225,000 yuan per tonne. according to the Shanghai Metals Market.

The price fell by 9,000 yuan per tonne in the recent five days and by 82,500 yuan in the recent 30 days.

The price of battery-grade lithium hydroxide fell by 1,500 yuan per tonne to 205,500 yuan per tonne, marking a new low in more than three months and sliding for the 27th consecutive day, according to the data.

The price fell by 14,500 yuan per tonne in the recent five days and by 78,000 yuan per tonne in the recent 30 days.

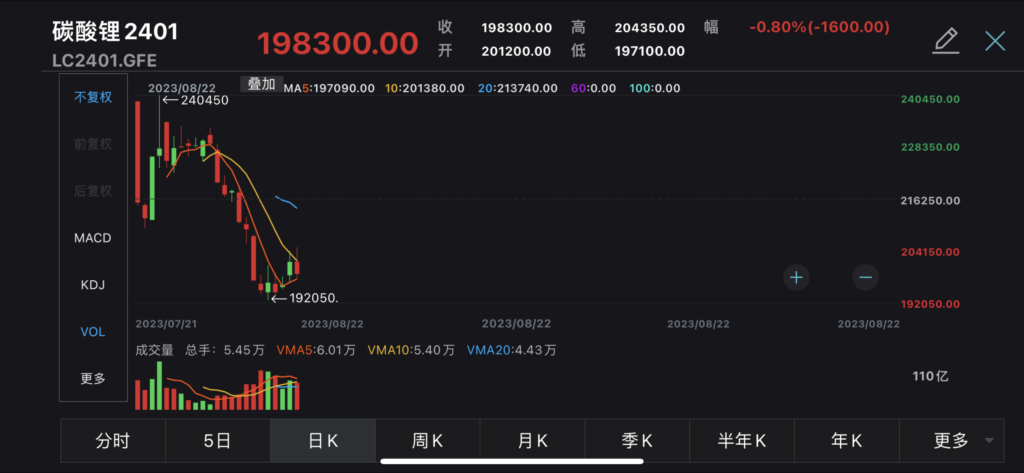

“There’s no news that can support the spot market and meanwhile, the most-traded January lithium carbonate futures contract on the Guangzhou Futures Exchange has dropped below 200,000 yuan per tonne mark, said a Chinese lithium trader. The January lithium carbonate futures contract fell 0.8% to close at 198,300 yuan per tonne on Tuesday.

Market participants widely expect spot prices to fall to that level in the run-up to January. There is still room for current spot carbonate prices to fall,” the trader said.

In addition, there is talk that a few major Chinese battery producers planned to lower their battery production in August, which sources attributed to the subdued appetite for spot lithium salts among Chinese cathode producers.

“Cathode makers in China are relying on long-term supply or supply provided by their customers, as the cathode producers struggle to shift the high production cost from lithium prices to their customers,” a Chinese lithium producer said.